Events Calendar

Contact us if you have an upcoming event you’d like to feature.

FEATURED EVENTS

ECOSYSTEM CALENDAR

PayDay Super Explained, Hosted by Monoova and SuperAPI

Forget the noise; learn what questions you should be asking of your providers, and what payday super really requires of Australian employers - and how payroll providers and employers can meet these obligations without adding operational or administrative strain.

In this webinar, you’ll hear from two organisations that have partnered to deliver something the market hasn’t seen before: a fully orchestrated, end-to-end Payday Super solution that fixes the actual root causes of contribution failures, not just the symptoms.

SuperAPI will break down how real-time Tax File Number, bank account validation, and Super Membership validation enables orchestration that eliminates payroll errors before they happen.

Monoova will unpack the payment infrastructure and rail optimisation behind reliable, secure, near-real-time settlement.

In 60 minutes, we’ll cover:

• What Payday Super really requires under the new rules

• Why the Employers should demand that their Payroll and Superannuation contributions happen in the one place...inside payroll!

• How data orchestration + intelligent routing closes the compliance gap

• How this combined solution removes the need for employers to manage payroll and super in different systems

Expect a practical, candid session focused on exactly what you need to know — and what you need to prepare — ahead of the changes.

WeMoney Financial Wellness Summit 2025

Bringing together the hearts and minds of the world’s most influential thinkers to shape the economic future for our children and grandchildren.

Australia is at a crossroads. We’re confronting some of the toughest financial challenges in our history—record household debt, rising living costs, deepening inequality, and a financial literacy gap that’s leaving too many people behind. At WeMoney, we believe we can change this narrative. The Summit unites leaders and problem-solvers eager to reimagine what financial wellbeing looks like for every Australian and for generations to come.

Key Details:

📅 Date: Monday 3 November 2025

📍 Venue: Domain Theatre, Naala Nura Building, Art Gallery of New South Wales

🥂 Networking: Post-event reception at The Terrace at the Domain

FinTech Australia Members get 20% Off. Use code: FINTECHAUSTRALIA20

By 2026, AML Compliance Goes Real Time | FrankieOne Webinar

AML regulation is changing. Fast.

With new reforms landing in 2026, businesses that still rely on static, point-in-time KYC checks risk falling behind. Regulators now expect continuous compliance.

So what does that mean for your compliance team? 🧐

On October 30, join leading experts who will share:

▶️ The most important AML/CTF updates, explained simply

▶️ Why leading firms are shifting to continuous monitoring

▶️ Practical steps to build resilience and avoid missteps

Speakers:

🎙️ Jeremy Moller (Senior Advisor, Risk Advisory - Norton Rose Fulbright)

🎙️ Celeste De Highden, GAICD (Operational Resilience &

Financial Crime Lead - HESTA)

🎙️ Ronald Daliya CAMS (Director, Financial Crime - Intelleqt Consulting)

🎙️ Patrick Lynch (Senior Account Director - FrankieOne)

Webinar details:

📅 Thursday, 30 October | 11AM–12PM AEDT

CDR Symposium

The CDR Symposium is a half-day event designed for B2B Fintech Product Managers and Strategists seeking clarity and practical guidance on how Consumer Data Right (CDR) fits in their roadmap. Hosted by SISS Data Systems, this event offers practical guidance from experts and focused use cases so participants can plan and execute confidently.

Hear from leading voices like Jamie K Leach (Open Data Strategist, Raidiam), Lara Thompson (Head of Partnerships APAC, Intuit) and Daniel Knight (Partner, K&L Gates), along with other leaders in open banking.

In just one morning, you will:

Gain clarity on CDR and its urgent relevance

Compare access models (ADR, Representative, Sponsor, BCDC & more)

Understand how each model impacts compliance, liability, UX and data quality

Learn from open banking pioneers with real implementation experience

Leave with practical takeaways you can apply right away

The program includes panel discussions, opportunities to engage with trusted advisers, and practical sessions focused on implementation.

Hilton Sydney, 488 George Street, Wednesday 29 October 2025, 8:00 am–2:00 pm.

FinTech Australia members: $199 (Use Code: FINTECHCDR2025); Full price: $299.

Limited tickets - secure your spot now.

Diving Into Real-Time Payouts | Zepto Connect Webinar

Real-time payouts have been a proven winner across industries as a driver of great customer and stakeholder experience.

From real-time payments to vets, quick consumer refunds, investment and wagering payouts, as well as insurance claims, real-time payouts have quietly been a deliverer of massive impact in the real-time payments space for years now with good reason.

Join us to find out why this elegant, versatile solution is such a driver of innovation and customer satisfaction at our virtual fireside chat hosted by Zepto's Kim Yan, and featuring Refundid’s Joel Aaron, Fetch’s Phil Wilson-Brown and Zepto’s Ian Lennie.

Stripe Tour

Join Stripe Tour Sydney 2025, a one-day annual conference happening on Thursday, 11 September.

Stripe Tour gathers industry leaders to explore the future of commerce, focusing on the trends that will shape payments and global trade in the next decade. Attendees will hear from speakers, including Rowena Westphalen, senior vice president of innovation, AI, and customer advisory at Salesforce, and Caroline Bowler, CEO of BTC Markets. Breakout sessions will delve into future revenue models, new applications of AI, and strategies for enhancing customer experience. Don't miss the opportunity to network with peers and gain insights from Stripe product experts who can help your business drive customer value and adapt to evolving market demands.

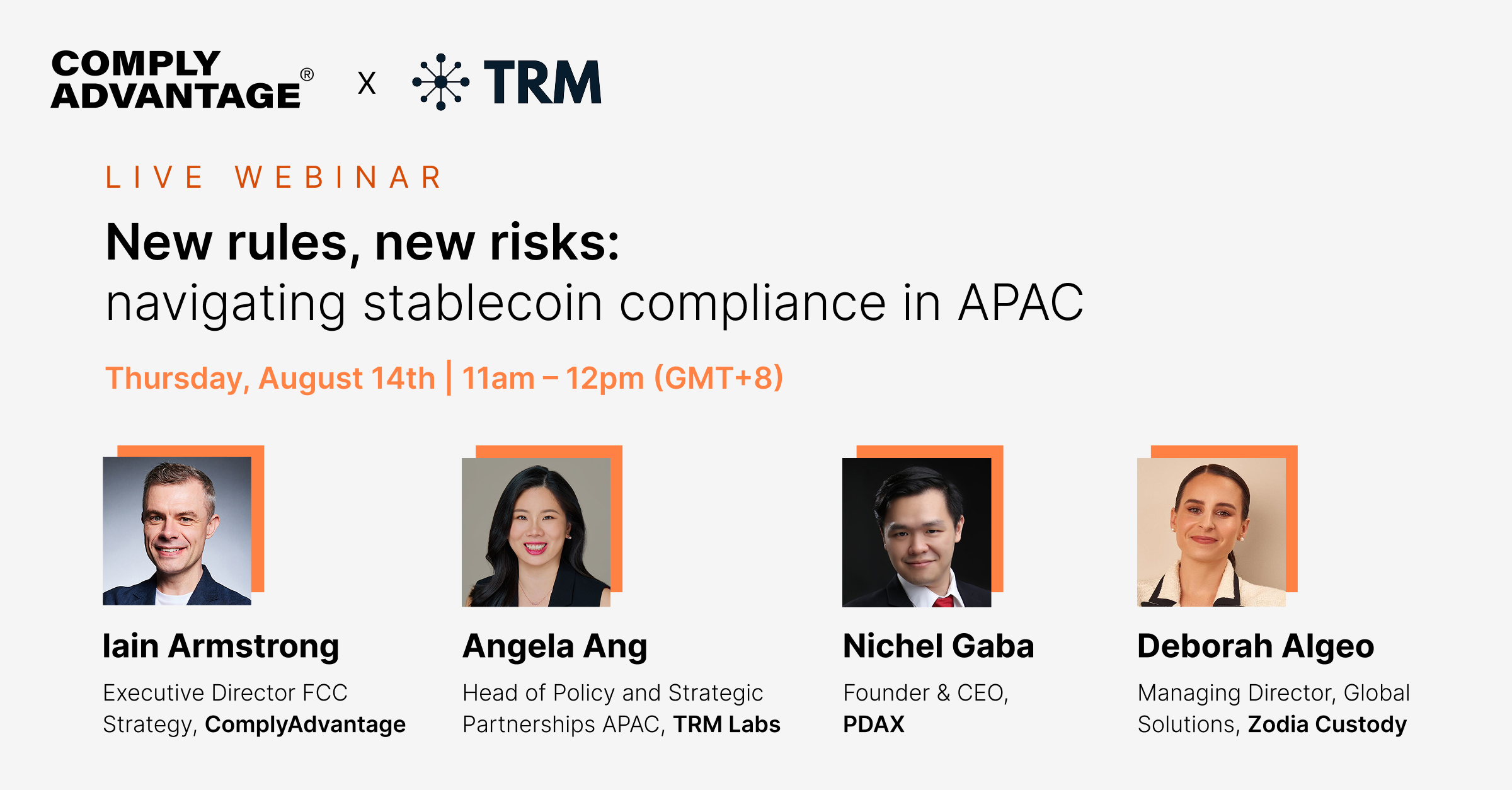

Navigating Stablecoin Compliance in APAC | Webinar by ComplyAdvantage

New rules, new risks: Navigating stablecoin compliance in APAC

How are APAC regulators and industry players shaping the future of stablecoin payments, and what does that mean for your compliance framework? This session decodes key regulatory updates and outlines how teams can detect illicit activity, manage exposure, and stay audit-ready.

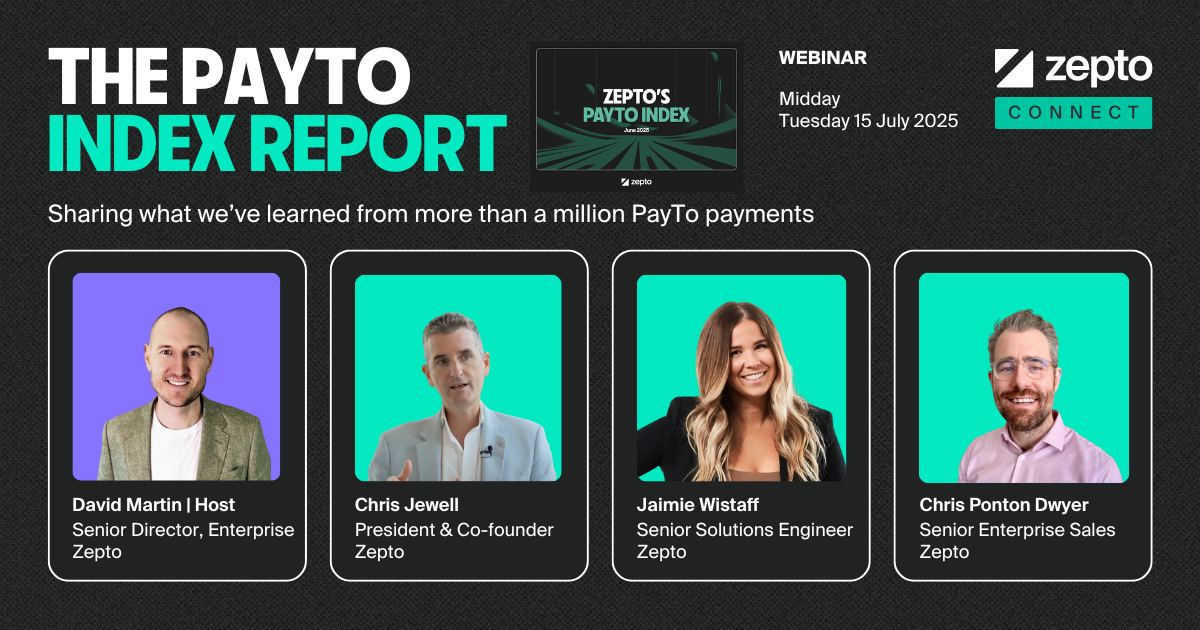

Webinar | Zepto PayTo Index Report

Zepto is delighted to share its inaugural PayTo Index report with you in this interactive webinar presentation.

With more than a million successful PayTo payments now under our belt, this inaugural report leverages Zepto’s unique data and market insights to map the progress, challenges, and opportunities surrounding PayTo adoption.

Join us for the key highlights of the PayTo Index report including:

Ecosystem-wide considerations

Broad market momentum

Insights: What we're seeing

Use Case Insights

Analysis: Adoption patterns and challenges

Conversion rates across banks

Industry, sector and consumer challenges

Application and benefits across sectors

Actions you can take now

IDmeta AML Compliance Unlocked

Why Attend?

With Tranche 2 AML/CTF reforms now extending AUSTRAC obligations to legal professionals, compliance is no longer optional—it’s imperative. Join us for an exclusive, solutions-driven evening where compliance transforms from a burden into a strategic advantage.

IDmeta’s innovative eKYC platform will showcase how to easily equip your firm with inexpensive, secure Cloud based digital processes that protect your clients, effectively achieve your AML compliance deadlines and protect your reputation.

Agenda Highlights

5:00 PM – Arrival & Refreshments

Network with peers over curated beverages and canapés

5:30 PM – Keynote: Navigating Tranche 2

Regulatory Deep Dive: AUSTRAC’s timeline, penalties, and critical obligations for LSPs

Platform Demo: See IDmeta’s eKYC solution in action—real-time client onboarding, risk scoring, and seamless PMS/eCRM integration

Case Studies:

Up-to-date insights: We cover the latest regulatory changes, emerging risks, and best practices in AML compliance

Practical Approach: Forget theory. Our session will showcase a real working legal firm solution using IDmeta’s compliance platform

6 PM – Session Ends

Post-Event Networking: Continue the conversation at Natural History Bar & Grill

Why This Isn’t “Just Another Compliance Session”

Actionable Insights: Walk away with a roadmap for immediate implementation.

Exclusive Access: First look at IDmeta’s AUSTRAC-ready workflows, designed for legal professionals, by legal compliance experts.

Trusted Expertise: InPlace Solutions’ wealth of legal tech experience, paired with IDmeta’s globally certified eKYC technology.

RSVP Today – Limited Seats Available

Secure Your Spot: verify@idmetagroup.com

Beyond Tomorrow 2025

Secure your ticket for Beyond Tomorrow 2025!

Back for its second year, the Australian Payments Plus summit, Beyond Tomorrow, is where the future of payments and digital identity comes to life.

Join us on 25 March 2025 at ICC Sydney to be part of the conversation and unleash opportunities for the future.

Explore what's next: Gain insights into how Australia’s payment and identity systems are transforming to be more efficient, long-lasting, and future ready.

Uncover unique learning experiences: Across the day, we'll uncover the biggest challenges and potential solutions facing our industry to keep you in the know.

Forge meaningful connections: Connect with peers, experts, and innovators from across the industry.

30min to simpler, technology driven expense management | Webinar by Budgetly

Are you ready to reduce your time spent on expense processing by 70%?

Are you one of the 42% of employees feeling stressed by admin tasks including expense management?

Budgetly helps you manage spending and expenses as they happen.

Outdated expense management processes could be holding your business back—costing you valuable time, resources, and peace of mind. But there's a better way.

Join us for an exclusive webinar with leading finance managers where they share how they revolutionised their spend management by embracing modern technology. This engaging panel discussion will uncover the biggest challenges businesses face with traditional expense management—like limited budget visibility, lost receipts, and inefficient systems—and reveal how innovative solutions are transforming the way companies manage their spending.

Don't miss this opportunity to learn from the experts and gain actionable insights that can help you automate your processes, enhance financial control, and empower your employees.

FinTech Startup/Scale Up Basketball

Teamified, AWS, DoiT, and Thoughtworks are getting the FinTech community together for some hoops and networking on Wed, Nov 27th from 9-11am.

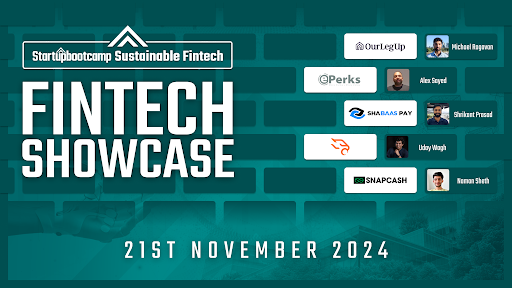

Startupbootcamp's Fintech Showcase - Meet Fintech Startups (Melbourne)

Startupbootcamp is hosting an exclusive event for the Fintech community in Melbourne.

Listen to Fintech Startups Pitch LIVE

Meet our Fintech Alumni - Where they are now?

Hear Updates on the Fintech Global Market

Connect with Fintech Industry Leaders

Agenda

Doors open: 5:00 PM

Startups Begin Pitching: 5:30 PM

Networking and Drinks: 6.30 PM

Doors close: 8.00 PM

Think & Grow Christmas Came Early - Cocktail Party

Think & Grow and Worldpay are hosting an end of year cocktail party at the Boatbuilders Yard in Melbourne on the 20th November. Open invite for industry leaders to round out the year and look forward to 2025.

Date: Wednesday November 20th

Time: 5:30 PM – 9:30 PM

Location: The Boatbuilders Yard, 23 S Wharf Promenade, South Wharf

Securing the future: Fraud prevention, privacy, and innovation in payments - CRC-P Industry Workshop

Securing the future: Fraud prevention, privacy, and innovation in payments

This free workshop offers an in-depth look into securing the future of payments, with industry leaders and experts covering the latest in fraud prevention, privacy protection, and payment technology.

Hosted by RMIT University's Centre for Cyber Security Research and Innovation in collaboration with Novatti and Deakin University, this event brings together academia and industry to provide the latest insights. The workshop features expert talks, a panel discussion, and ends with networking drinks and nibbles.

Arca Credit Summit 2024

The Arca Credit Summit brings together professionals in credit risk, data tech and compliance.

This is the event to hear from the foremost experts about cutting edge developments, regulatory challenges and different industry practices. Attendees will gain new insights, participate in engaging discussions, and network with peers to shape the future of the industry.

Integrating CRM & KYC Data for a Better Client Experience

Find out how to create a brilliant customer experience by integrating your CRM & KYC data - register for our webinar today.

Stripe Tour Sydney

Join us for Stripe Tour, our global roadshow that brings together business leaders in major world cities to discuss the most important trends in payments and financial technology.

Stripe Tour Sydney 2024 brings the best parts of our annual conference, Stripe Sessions, directly to you. Hear from both industry experts and fast-growing Stripe users on how to drive customer value, adapt quickly to economic and technological changes, and ensure longevity in the marketplace.

EOFY Party: Finance Leaders Unwind!

🎉 EOFY Party: Finance Leaders Unwind! 🎉

Join us on June 27th at 5:30 PM for an hour of fun, laughter, and celebration as we wrap up the financial year in style! Hosted by the fabulous people of Cake Equity, FiT, Planet Startup and Tidal.

Whether you're a scale-up finance leader, a firm partner, or a virtual CFO, this is the perfect opportunity to unwind, share experiences, and toast to all the hard work and achievements of the past year. 🥂

📅 Time: 5:30 PM to 6:30 PM

📍 Location: Riverland, Brisbane CBD - Booths 167 Eagle St, Brisbane City QLD

So mark your calendars, bring your best party spirit, and get ready to unwind with the best in the biz.

We are excited to have you join us — see you there! Registration approval is required to attend.✨

Accounting for SMBs in 2025: AI + ESG + Open Banking

Accounting for SMBs in 2025: AI + ESG + Open Banking

Panel discussion & networking event

The Gallery Room, State Library of NSW

5:30pm - 8:30pm, Thursday 27 June, 2024

Brought to you by SISS Data Services in conjunction with Fintech Australia

Hosted by SISS Data Services, and as part of FinTech Australia’s CDR Summit, we’re bringing together thought leaders to discuss the three big issues influencing SMB Accounting as we head into the 2024/25 financial year.

Our distinguished panel will discuss three key issues that will influence the financial reporting and decisions made by Australia’s 2.5m business in the year ahead:

Artificial intelligence

Environmental, Social & Governance (ESG)

The Consumer Data Right (CDR) and Open Banking

Panellists will reflect on their approach to these issues, the interplay between them, and the practical implications for Australian businesses and those who advise them.

The Panel:

Chitra Andy Rajan - ANZ Small & Medium Business Lead, Microsoft

Lars Leber - Vice President, Australia & Rest of World, Intuit QuickBooks

Lochie Burke - Co-founder and CEO, NetNada

Rebecca Mihalic - Director, businessDEPOT

Grant Augustin - Founder & CEO, SISS Data Services

Moderator:

Trent McLaren - Accounting thought leader, Founder of Journey

With opening remarks by:

John Dunkerley - Fintech, ClimateTech & AccountingTech expert

Agenda:

5:30 - 6:30 Arrival drinks

6:30 - 7:15 Panel discussion

7:15 - 8:30 Refreshments & Networking

Invited attendee groups:

Business & financial leaders from small and medium businesses

Leading accountants & bookkeepers & representatives from professional bodies

Fintech, ESG & Accounting technology providers and ecosystem members

RSVP by: 20th June 2024

We look forward to seeing you there!

#ATC24 2-Day International Growth Masterclass

The Australian Tech Competition is running a 2 day Masterclass in Sydney and there's 10 spots open to Founders who didn't apply to join us!

Where: Collider - Tech Central Sydney

When: 18th + 19th June

What: A 2 day Talk/Workshop program guided by Industry experts & networking

Who: An intimate group of 60 Founders looking to scale

As a participant, you will have the opportunity to learn from a range of industry experts, government representatives, past ATC winners and Judges as well as network with fellow semi-finalists and eco-system partners.

The interactive sessions and panellist discussions will equip you with knowledge, contacts and resources to develop and advance your businesses in challenging international markets.

Seating is limited, so secure your tickets now before it sells out.

This 2-day Masterclass Program provides:

Curated presentations and expert panel discussions on key international growth topics

Networking with fellow innovators, government partners, industry specialists and investors

Tools, resources and coaching from the Judges to help scaling businesses grow, commercialise and succeed

Specific information on how to complete the Business Plan required for Semi-Finalists in the next phase of the competition

Catered food and drinks: morning tea, lunch and afternoon tea

Cocktail Networking Reception after Day 1

Topics will range from the R&D Tax Incentive, raising capital, perfecting your pitch, entering new markets and more. There will also be time for you to ask questions and interact with panel discussions.

Unlocking the Power of Open Banking: A Safe and Secure Financial Future for Australians

Join WeMoney for an insightful event hosted by FinTech Australia at Riff (Spacecubed) in Perth, focusing on the transformative potential of the Consumer Data Right (CDR) and Open Banking in Australia. This event is designed to help understand how Open Banking can create a safe and secure financial future for all Australians.

Event Details

Date: 17th of June 2025

Time: 5:00pm AWST

Location: Riff (Spacecubed) 45 St Georges Perth WA

About the Event

The Consumer Data Right “Open Banking” is set to unlock the power of financial data, creating new opportunities and improving financial services for Australians. This event will delve into the current state of progress with the CDR, alongwith exciting exclusive insights into the future.

FinTech Australia is the largest member based organisations.

Who Should Attend

This event is perfect for:

Financial Industry Professionals: Banking and Finance industry leaders, and analysts looking to stay ahead in the evolving financial landscape.

Fintech Enthusiasts: Entrepreneurs, developers, and tech enthusiasts eager to explore the latest trends and innovations in financial technology and are looking to build the future of financial services.

Policy Makers and Regulators: Individuals involved in shaping the future of Australia's financial regulations and consumer data rights.

Anybody who wants to learn more about the Consumer Data Right, Open Finance and Open Banking.

Special Guest Speakers

We are honoured to have a distinguished panel of speakers, including:

Senator Dean Smith (Shadow Assistant Minister for Competition, Charities and Treasury): Representing Western Australia, Senator Smith As a key advocate for consumer rights and competition, he will provide valuable insights into the views policy and the promise of an innovative financial future leveraging the Consumer Data Right

Rehan D'Almeida: CEO of FinTech Australia, Rehan brings a wealth of knowledge about the fintech landscape and will discuss the broader implications of CDR on the industry.

Ruth Hatherley: CEO & Founder of Moneycatcha, Ruth will share her CDR journey on how Moneycatcha approaches product and pricing offers via the Regchain platform and her experience to date.

Dan Jovevski: Founder & CEO of WeMoney, Dan will share practical examples of how Open Banking can empower consumers and improve financial well-being through the unique journey at WeMoney.

In addition to our featured speakers, we are excited to announce that more industry experts and thought leaders will be joining us. Stay tuned for updates on our additional guest speakers who will bring diverse perspectives and expertise to the discussion.

Why Attend?

Gain Insights: Learn from leading experts about the opportunities and challenges of Open Banking.

Network: Connect with professionals, innovators, and enthusiasts in the fintech and financial services sectors.

Stay Informed: Keep up-to-date with the latest developments in financial technology and regulation.

Don’t miss this chance to stay ahead in the ever-evolving world of tech and finance. Unlock the potential of Open Banking and discover how it can create a safer and more secure financial future for all Australians.

Spaces are limited, book your FREE spot now.

TreviPay Fintech Seminar: Payments at the Crossroads - London Event

2024 is shaping up to be the year of B2B in fintech and innovation is happening at the crossroads of consumer and business models. Join us to set your enterprise up for success.

Join TreviPay and industry insiders at our exclusive B2B payments forum. Sit down with payments, eCommerce and banking leaders for an energizing conversation around industry trends, how to drive growth by offering more payment options and why AI and automation are game changers.

Navigating the Future of Insurance — Monoova

Join us for an engaging exploration of the evolving landscape of the insurance sector, looking at the changes, challenges, and implications for your business.

Hear from a panel of industry experts on how to prepare for these shifts and capitalise on new opportunities in digital transformation and emerging payment trends including payment optimisation.

Panel guests include:

Dhun Karai, Non Executive Director, Partner Financial Advisory, Grant Thornton Australia

Anna Cranney, Partnerships Manager, Insurtech Australia

Geoffrey Dirago. Vice President, APAC, Guidewire Software

Johan Nelis, Snr Director, International Solution Consulting, Duck Creek Technologies

Edward Wiley, Head of Growth, Monoova.

Schedule

12:00PM Registration, buffet lunch available

12:30PM Panel discussion

1:30PM Networking

Unlocking more choice for consumers through CDR data.

Regchain is hosting an in-person event in Sydney on Tuesday, 28th May, commencing at 5pm.

The event will include drinks and nibbles, plus time for networking.

It will feature a panel discussion hosted by Annie Kane, the esteemed Mortgages Editor of The Adviser Magazine, on the topic of: "Unlocking more choice for consumers through CDR data."

Annie will be interviewing an expert panel, comprising:

Ruth Hatherley from Regchain

Mike Page from MogoPlus

Lance Goodman from Compare Club, and

Sam McCready from AFG.

There will be lots to talk about, and there will be a focus on home loans, which is highly relevant with Australia in the grips of a housing affordability crisis.

The event will be especially relevant for mortgage brokers, aggregators, bank and non-bank home lenders, consumer advocates, credit analytics providers, personalisation and behavioural finance experts, open banking providers, fintechs, technology providers, regulators ... and more!

Registration is free and open to all interested parties.

Webinar: Australian Commercial Risk Barometer | illion

New report finds insolvencies could double in 2024 Following the launch of our Consumer Credit Stress Barometer in 2023, we are now launching a Commercial Risk Barometer.

In this new report, illion data scientists analyse key commercial data points to predict likely economic outcomes in the future.

A significant finding in our latest report is that business failure risk has risen by more than 6% in the 15 months to March 2024. This follows a long period of stability up to the end of 2022, likely due to government and lender support of smaller businesses.

The overall rise in business failure risk means that close to twice as many businesses are now at risk of forced closure compared to this time last year, either through liquidation or involuntary deregistration.

Ultimately, insolvencies in 2024 may be up to double those seen in 2023.

Don’t miss this important webinar where illion data scientists and business experts discuss which sectors are most at risk, and where they are located.

Next-Gen Family Offices: Capitalising on Venture Opportunities

Join us for an intimate discussion about the next generation of family offices using Venture Capital in their portfolio construction to drive differentiated returns. Next-Gen Family Offices: Capitalising on Venture Opportunities is an invite-only event designed in collaboration with Euphemia, Larsen Ventures, and Co Ventures.

We'll also touch on:

How to think about different stages of investment risk and their impacts—pre-seed, seed, Series A, and growth.

How to find strategic venture alignment with your family office.

Emerging fund managers and the opportunities they present.

Your speakers:

🎤 Dominic Pym - Founder, Euphemia: Investing in Tomorrow's Startup Scene

🎤 Maxine Minter - General Partner, Co Ventures: Australia's First Dedicated Pre-Seed Solo GP Fund

🎤 Andrew Larsen - Investment Director, Larsen Ventures: Family-backed investment fund

Your hosts:

As a family office, Euphemia also invests in venture capital and private equity funds, traditional asset classes, and the Euphemia Foundation (to support people in need). They have more than $15m invested in more than 20 venture funds globally, including at least a dozen Australian funds.

Co Ventures invests in Australian-founded pre-seed companies that will grow to the US, where Co Ventures can help accelerate them into the US ecosystem. Join this event to learn more about Co Ventures before its final fundraising close in June 2024.

Aside from his work at Larsen Ventures, Andrew is also a partner at Folklore Ventures and a board member at several growth-stage startups.

Postcard from Miami: The Nacha Smarter Faster Payments Conference

Each year over three days, the annual Nacha Smarter Faster Payments Conference is the centre of the real-time payments universe.

At this year’s conference in Miami, Zepto’s Chris Jewell and Elizabeth McQuerry [Partner, Glenbrook Partners] are co-presenting the conference’s 'Enabling Commerce in Faster Payments' session which looks at the importance of building robust instant payment ecosystems, and highlights the different pay-by-bank solutions from around the world including Australia's world class PayTo.

But there’s so much more to this global gathering of the payments cognoscenti than that.

Among the keynotes and celebration of Nacha’s 50th anniversary, the conference streams will meander through a mountain of topics including:

Disruptive Ideas & Technologies

Smarter Payments Experiences

Faster Payments Experiences

Compliance & Regulation

Cybersecurity & Risk

Join the Postcard from Miami: The Nacha Smarter Faster Payments Conference virtual fireside chat on the 15th of May.

Webinar: Non-Bank Lenders - Understanding the Consumer Data Right

As the Consumer Data Right expands its reach, incorporating the non-bank lender sector, it's crucial to explore the challenges, risks and strategic opportunities it will present to you. Join us as we hear from 3 guest speakers with deep experience in the CDR rollout to banks as they explore the challenges and opportunities, whether directly impacting your business or not. This will be an interactive and open session with an opportunity for a Q&A .

Guest Speakers:

Anthony Fitzgerald, CEO, OpenAssure

Ruth Hatherly, CEO and Founder, Stryd

James Bligh, CTO and Cofounder, ProductCloud

Moderated by: Mark Evans, CEO and Cofounder, ProductCloud

Securing and Preventing Fraud in Digital Payment Systems - CRC-P Industry Workshop

RMIT’s University's Centre for Cyber Security Research and Innovation, in proud partnership with Novatti and Deakin University, is delighted to invite you to a free afternoon workshop in Melbourne.

The workshop will feature interesting talks from RMIT, LaTrobe University, and Novatti. Join us to get insights into the current challenges, legal implications, and emerging trends in fraud prevention and security in payments.