Quickli launches all-new Pro tier, packed with high-impact broker tools including its first AI products

11 February 2026, Sydney: Quickli, Australia's leading technology platform for mortgage brokers, has launched an all-new premium subscription tier designed for brokers and mortgage businesses seeking advanced automation and enhanced capabilities.

Quickli Pro builds on the legacy of Quickli’s core platform, now used by more than 13,000 mortgage brokers, and includes the company’s first AI products including Jiffi AI, Quickli’s inbuilt AI policy and product research tool, as well as Doc Renamer, which automatically detects and renames client documents at scale, all available in custom branding.

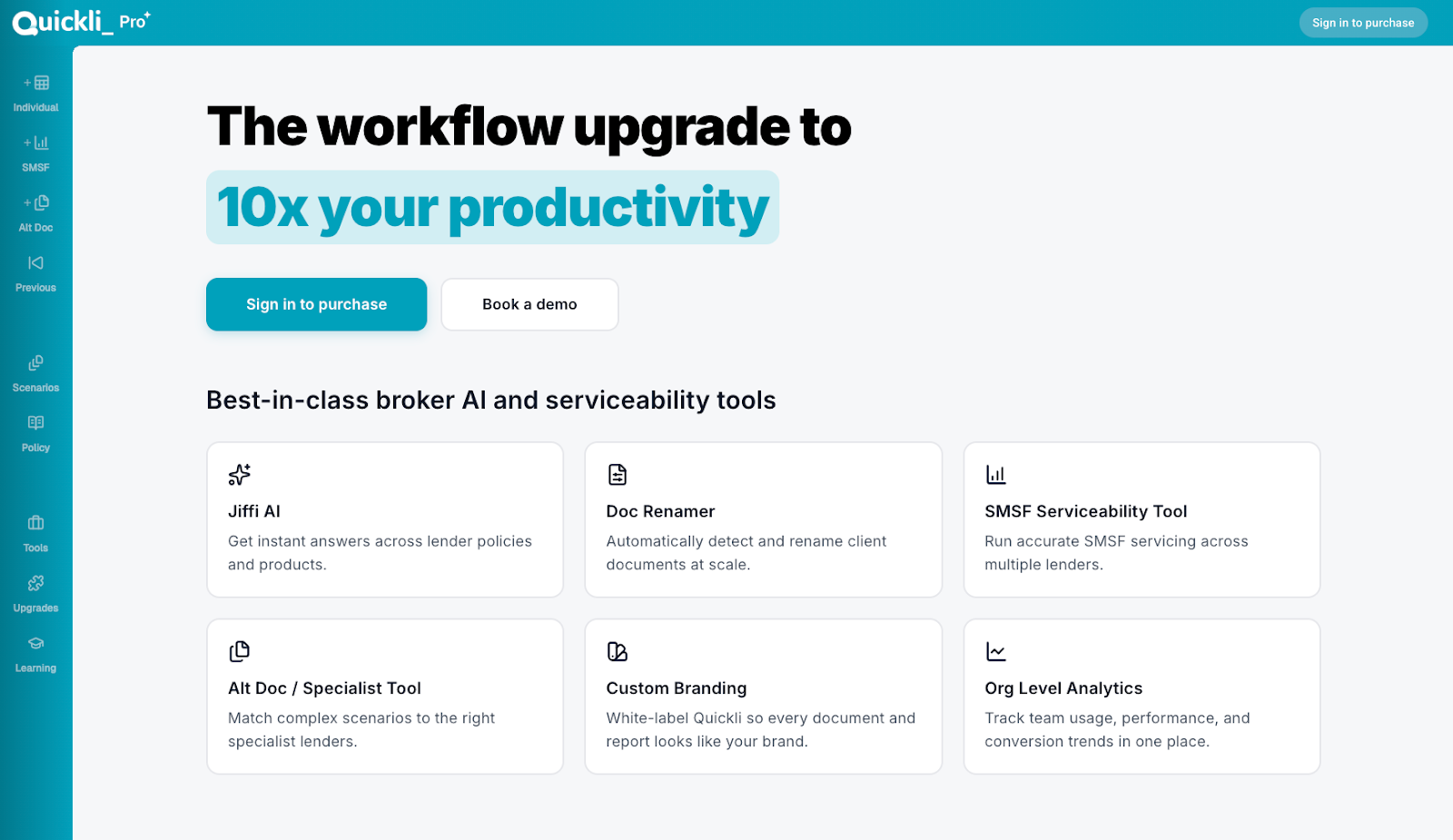

What’s inside Pro:

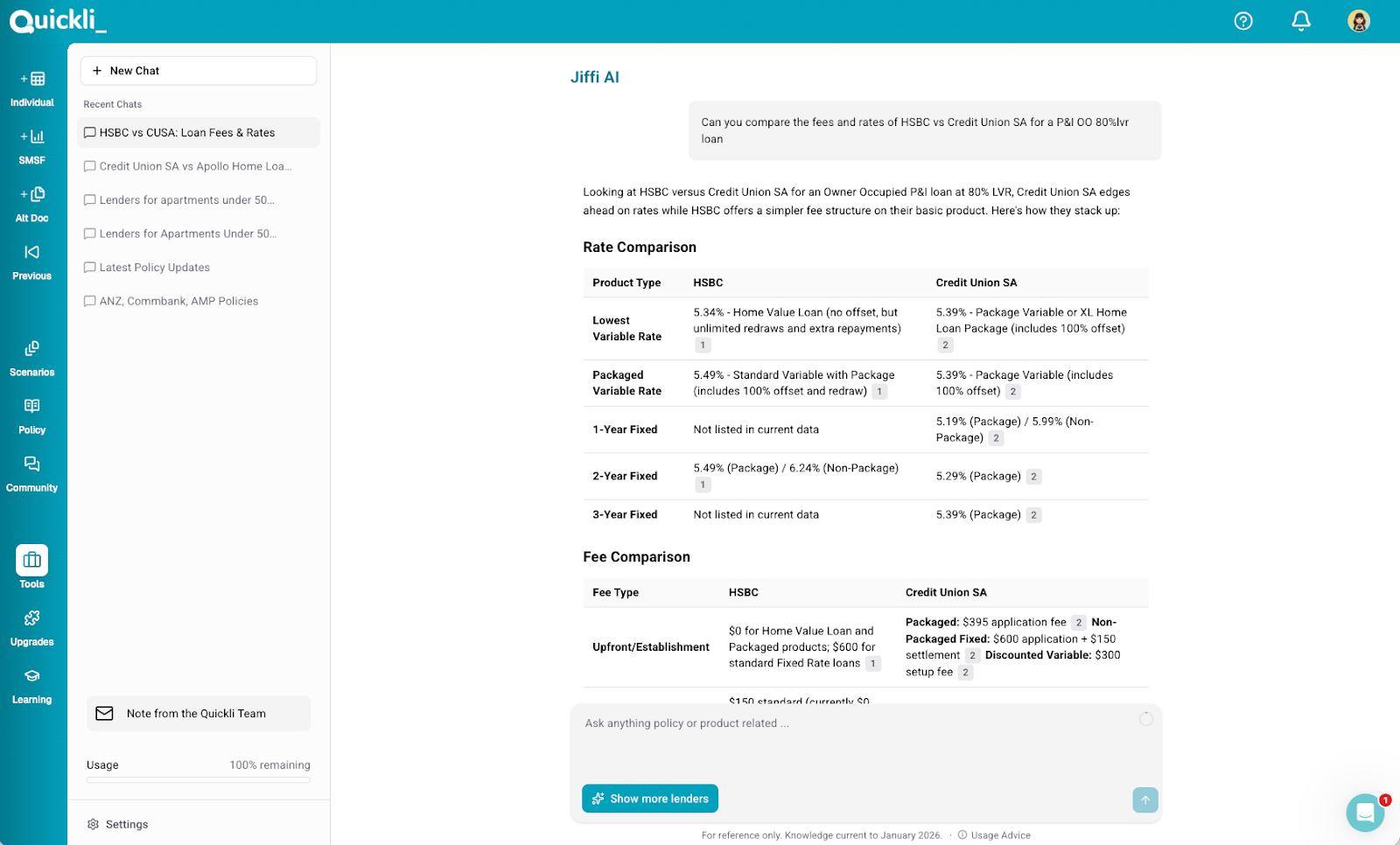

Jiffi AI - the world's most advanced AI Credit analyst that provides instant answers across policy and product for 45 Lenders. Eliminating hours of manual research.

Doc Renamer - an AI efficiency tool that renames all your document types exactly how you want them in seconds, not hours.

Industry-first Alt Doc / Specialist Tool - uses a policy-driven rules engine to automatically surface suitable lenders based on a client’s ABN history, documentation type, BAS history and credit profile, helping brokers confidently identify viable specialist lending options faster.

SMSF Serviceability Tool - available exclusively to Pro subscribers. Currently integrated with more than seven of the top SMSF lenders in this space (more lenders on the way).

Custom Branding - allows businesses to integrate their company identity throughout the Quickli interface.

Org Level Analytics - deep insights into your team's performance, deal pipeline, and conversion rates. Understand what's working, what's not, and where to focus.

Eric Dill and Angus Keatinge, Quickli co-founders and co-CEOs

Quickli co-founder and co-CEO Eric Dill said Pro represents the first phase of a broader product vision to deeply embed AI throughout the broker workflow.

“Quickli Pro is the beginning of a platform that is set to revolutionise how brokers operate… again,” he said.

"Every Pro capability solves a specific workflow challenge for brokers operating at scale. Pro gives them the additional firepower they need, whether it’s instant policy answers across thousands of pages, doc tools that read your mind, or industry-first products that save hours. These are tools that directly address the bottlenecks each and every broker faces every day."

“Imagine an AI credit analyst that can iteratively work through your scenarios for you with just a few prompts. We’re not there yet, but the path is clear. And we’re moving fast.”

“The foundation is being laid and as the months go by, brokers will begin to see the pieces coming together. Quickli Pro is only getting better from here.”

Quickli Pro is priced at $99 + GST per user monthly for individual brokers, or $89 + GST per user monthly for multi-user organisations. Standard Quickli subscriptions remain available for brokers seeking core serviceability calculation functionality.

Learn more at: https://app.quickli.com.au/quickli-pro

About Quickli

Quickli is Australia’s leading technology platform for mortgage brokers, designed to empower advisors by simplifying the loan assessment process.

By consolidating 50+ lender servicing calculators into one user-friendly interface, Quickli saves mortgage brokers hours every week on data entry, enabling them to present more accurate solutions to their clients, faster.

The platform has evolved since its launch in 2021 from a single calculator to a comprehensive broker ecosystem. Beyond core serviceability, Quickli offers lender-specific postcode lookup tools, detailed policy columns, white-label website widgets, an integrated broker Community for peer-to-peer support, and SMSF loan calculators. Each feature addresses specific broker pain points identified through direct customer feedback, transforming Quickli into what brokers describe as their indispensable daily workflow partner.

What truly distinguishes Quickli is its human-first approach. While competitors automate support, Quickli maintains a dedicated team of real humans delivering 90-second average response times to 13,000+ users. This combination of sophisticated technology and genuine human support has driven entirely organic growth through word-of-mouth – brokers recommending Quickli because it genuinely makes their work better.

With over 2 million scenarios created by over 13,000 users (there are approximately 22,000 mortgage brokers in Australia), Quickli has earned recognition for its contribution to the industry as:

- “Industry Supplier of the Year” at the 2025 Finance Brokers’ Association of Australia Awards of Supremacy

- “Service Provider Innovator of the Year” at the 2025 Broker Innovation Awards

- “Broker Technology Platform of the Year” at the 2023 and 2024 Mortgage Business Awards

- “Best Industry Service” at the 2023 Australian Mortgage Awards.

For more information, please visit www.quickli.com.au