LMG Asset Finance partners with LoanOptions.ai to bring cutting-edge loan technology to brokers

20 August 2025 — LMG Asset Finance brokers will gain access to LoanOptions.ai’s white-label AI loan widgets and integrated application forms – streamlining loan applications and enhancing the customer experience.

LoanOptions.ai, an AI-driven loan matching platform, today announced a partnership with LMG Asset Finance, a leading asset finance aggregator. The partnership will provide LMG Asset Finance’s network of brokers with access to LoanOptions.ai’s cutting-edge financial technology, including white-label B2C loan application widgets and digital application forms fully integrated with LMG’s MyCRM. This collaboration equips LMG’s brokers with a powerful new toolset to deliver faster loan approvals and a superior client experience.

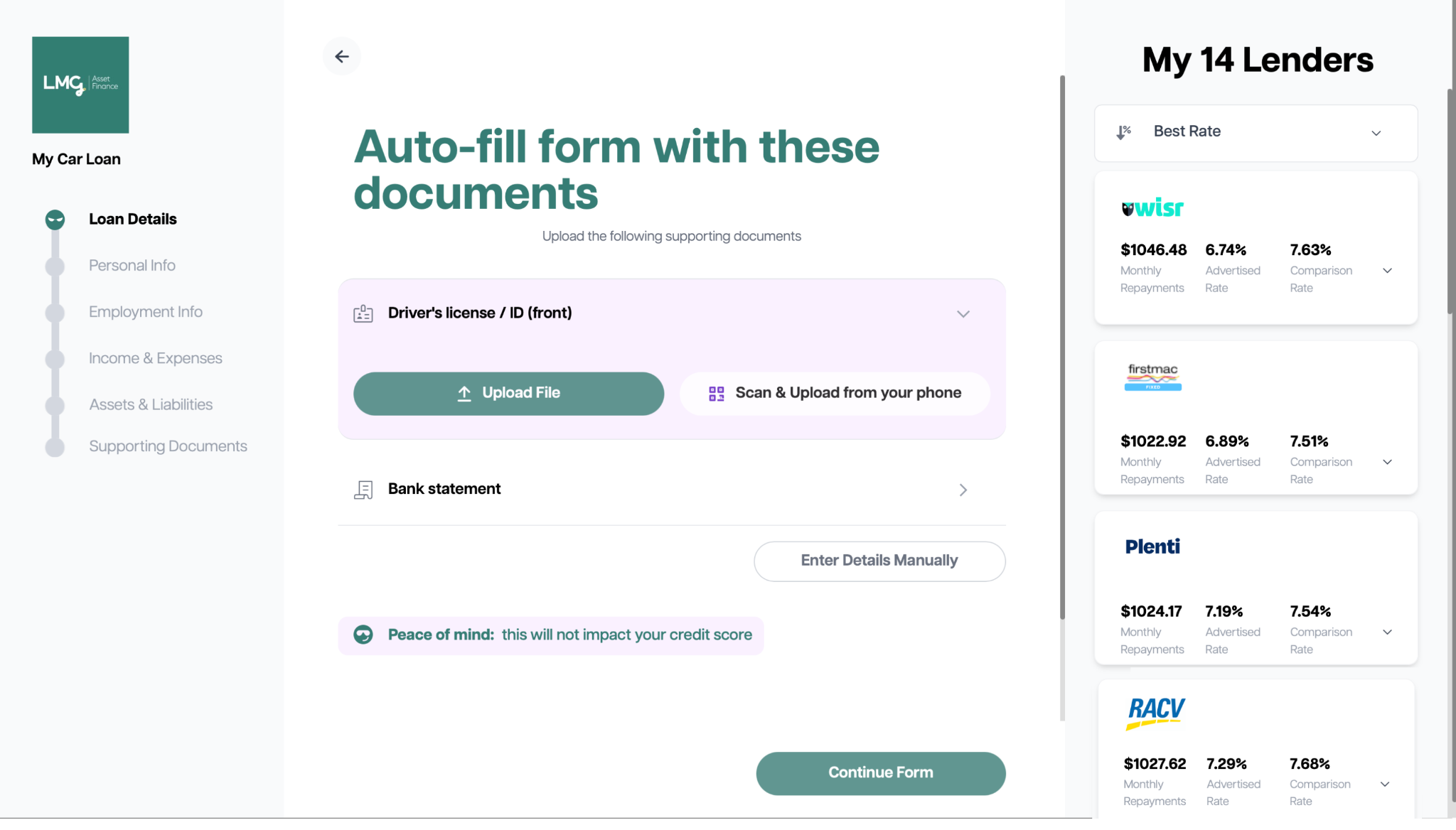

Under the partnership, LMG Asset Finance brokers can seamlessly deploy LoanOptions.ai’s technology under their own brand. Brokers will be able to embed LoanOptions.ai’s customisable loan application widget on their websites or use it directly with clients, enabling borrowers to complete a single online application and instantly view personalised loan options from a broad panel of lenders. All customer data captured through the widget flows securely into LMG’s CRM, eliminating duplicate data entry and allowing brokers to manage leads and applications end-to-end within their existing workflow.

For consumers, the integration promises an improved borrowing experience. Instead of a lengthy or paper-based process, customers can complete a streamlined digital loan application in minutes and receive tailored loan offers in real time. The platform’s AI-powered engine pre-fills information and automates document collection, significantly reducing paperwork and delays. Importantly, applicants can obtain initial quotes without impacting their credit score, giving them confidence to explore options. Borrowers also benefit from greater transparency – able to track their application’s progress online – making the journey from inquiry to approval more engaging and stress-free.

Brokers benefit from a more efficient process and the ability to deliver faster outcomes for their clients. With LoanOptions.ai’s tools embedded into LMG’s systems, brokers can easily broaden their services across personal, vehicle, equipment, and other asset finance loans through one integrated platform. The automation of data capture and compliance (including digital signatures on documents) means brokers spend less time on administrative tasks and more time building relationships and providing advice. Ultimately, LMG’s brokers will be able to focus on growth and customer service while offering a cutting-edge digital experience that sets them apart in the market.

This partnership underscores both companies’ commitment to innovation in financial services. LoanOptions.ai has pioneered the use of artificial intelligence to simplify lending, and LMG Asset Finance continues to invest in technology that keeps its brokers at the forefront of the industry. By joining forces, the two companies aim to set a new benchmark for how brokers leverage fintech to improve client outcomes and drive business growth.

"We’re excited to partner with LMG Asset Finance and put our cutting-edge tools in the hands of more brokers," said Julian Fayad, CEO of LoanOptions.ai. "Our mission has always been to improve the lending experience. By empowering LMG’s brokers with our technology, we’re making the loan process faster, easier, and more transparent for consumers. This partnership is about delivering practical innovation to brokers and enhancing the borrower experience, ultimately benefiting both sides."

"LoanOptions.ai’s vision and technology align perfectly with our commitment to broker success," said Tom Caesar, Group Executive at LMG Asset Finance. "We pride ourselves on being at the forefront of technology in our industry, and integrating LoanOptions.ai’s platform reinforces that. By leveraging this solution, our brokers can streamline their operations and deliver an even better experience to their customers. It’s a strategic move that strengthens our position as a technology leader in the asset finance space and enables our brokers to thrive in a digital-first era."

The rollout of the integrated LoanOptions.ai solutions to all LMG Asset Finance brokers nationwide is now live. Both companies will provide training and support ahead of the launch to ensure brokers can quickly take advantage of the new system. This partnership marks a significant step forward in the digital transformation of the asset finance industry, marrying the energy of fintech innovation with the trusted expertise of Australia’s broker network.

About LoanOptions.ai

LoanOptions.ai is an Australian fintech company and award-winning loan comparison platform that uses artificial intelligence to match consumers with tailored loan options from a broad panel of lenders. Founded in 2020, LoanOptions.ai has grown into Australia’s first AI-powered loan marketplace for all types of loans, offering a seamless online application experience for personal, car, business, and asset finance. In addition to its direct-to-consumer services, LoanOptions.ai provides a white-label solution for brokers and business partners, enabling them to leverage the company’s advanced technology to diversify their offerings and enhance their customers’ experience.

For more information, please visit loanoptions.ai

About LMG Asset Finance

LMG is the largest and most progressive aggregator group across Australia and New Zealand supporting a community of over 6,000 brokers and advisers.

Proudly family-owned and led, LMG supports businesses operating under their own brand, or the Loan Market brand, and partners with over 70 banks and lenders.

The business has grown rapidly, with LMG brokers in both countries helping over 330,000 customers settle over $126 billion worth of loans in FY24 and reaching a collective loan book of $370 billion.

For more information, please visit lmg.broker