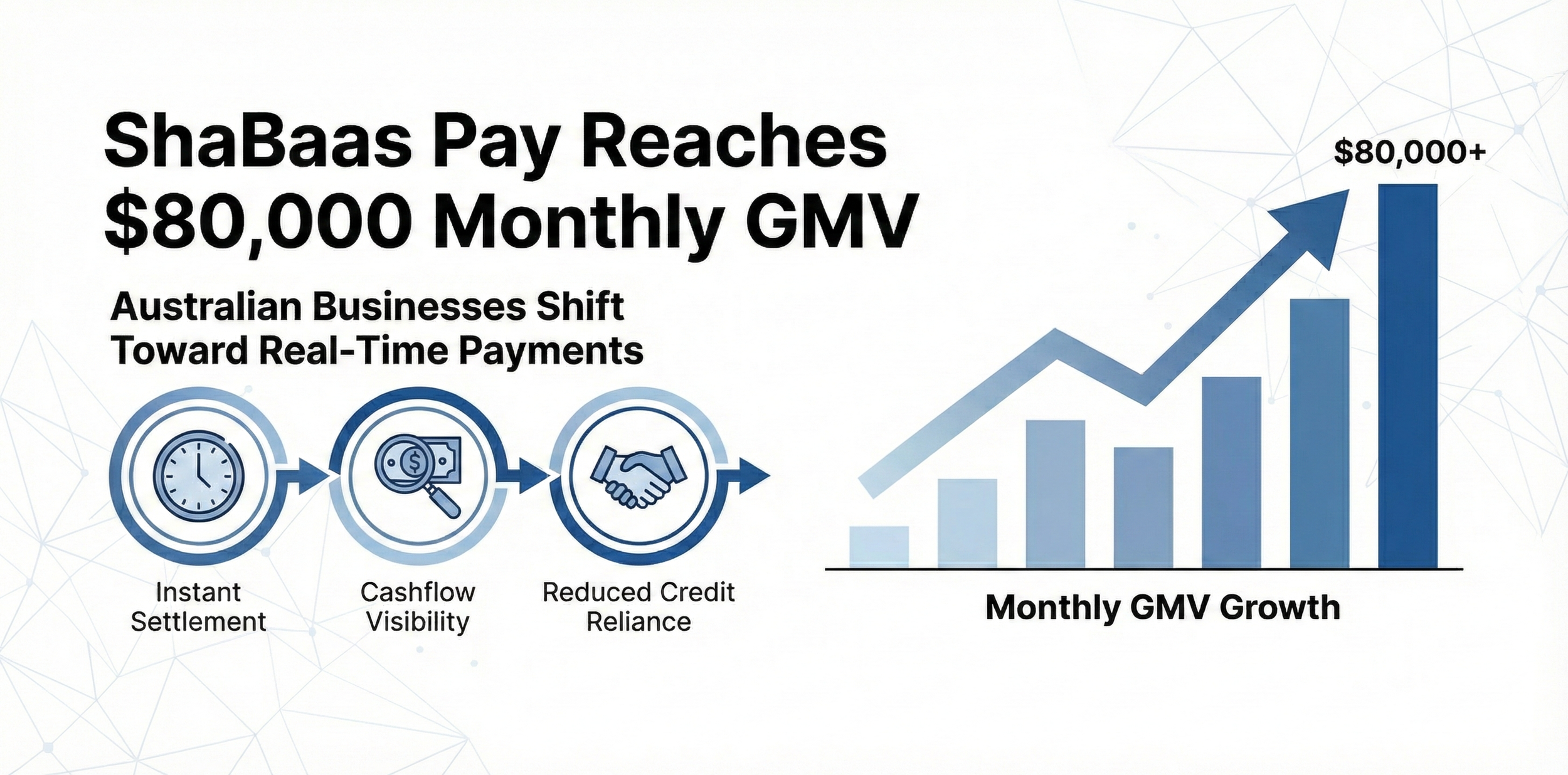

Australian Fintech ShaBaas Pay Crosses $80,000 in Monthly GMV as Demand for Real Time Payments Accelerates

ShaBaas Pay, an Australian real time payments infrastructure provider, is processing more than $80,000 in monthly gross transaction value (GMV) following the launch of its platform.

The platform is built on Australia’s New Payments Platform (NPP) and enables instant account -to- account payments using PayTo and PayID and secure request to pay capabilities.

ShaBaas Pay is designed to help businesses move away from traditional settlement cycles and operate with real time access to funds.

Traditional card and batch-based payment methods typically delay settlement by one to three business days. During this period, working capital remains locked in transit, reducing operational flexibility.

With interest rates elevated and the cost of capital increasing, delayed settlement is becoming a working capital constraint for many organisations.

ShaBaas Pay enables instant settlement directly into business bank accounts, helping organisations:

Improve cashflow visibility

Reduce reliance on short term credit or overdrafts

Accelerate service delivery and fulfilment

Strengthen financial planning and forecasting

“Businesses want certainty around when funds arrive, including weekends and holidays,” said Jo Kalra, Chief Operating Officer, ShaBaas Pay.

“Real time settlement gives them the confidence to operate with accurate, up to date cash positions. Reaching $80,000 in monthly GMV is an important early milestone that reflects this operational need.”

Early Adoption in Cashflow Sensitive Sectors - Initial transaction activity has been driven by industries where payment timing directly affects operations, including:

Professional and advisory services

Education and training providers

For these sectors, instant payment confirmation reduces administrative workload while improving liquidity and financial control.

“The biggest operational change for customers is visibility,” Jo added. “When payments are confirmed instantly, finance teams spend less time reconciling transactions and more time managing cashflow proactively.”

Infrastructure Focus: API First Real Time Payments - ShaBaas Pay is positioned as payments infrastructure, not a consumer wallet or payment app.

The platform allows businesses, software providers and marketplaces to embed real time bank payments into existing workflows using:

Hosted checkout

Payment orchestration

API based integration

Webhooks and real time reporting

This enables faster settlement without requiring organisations to manage complex banking integrations.

Industry Shift Toward Account-to-Account Payments

Australia’s payments ecosystem is moving toward account-to-account models powered by the New Payments Platform.

As businesses experience the operational benefits of instant settlement and real time reporting, delayed payment cycles are increasingly viewed as a legacy limitation.

“Real time payments are changing how businesses operate day to day,” said Jo. “Once organisations experience instant settlement, returning to delayed cycles becomes a constraint rather than a choice.”

About ShaBaas Pay

ShaBaas Pay is an Australian real time payments platform that enables businesses and platforms to accept instant bank to bank payments and operate with real time cashflow visibility. The platform provides hosted checkout, payment orchestration and API based integration built on Australia’s New Payments Platform. To learn more visit: https://www.shabaas.com